Fringe Benefits Tax (FBT) is a significant consideration for employers who provide motor vehicles to their employees. Understanding how to manage this tax can result in substantial savings and compliance benefits. This guide outlines the key aspects of FBT for vehicles, focusing on commercial versus non-commercial vehicles, calculation methods, and recent exemptions for electric vehicles.

Commercial vs. Non-Commercial Vehicles

Commercial Vehicles: Commercial vehicles, such as panel vans, utes, and trucks, are generally exempt from FBT if their personal use is minor and infrequent. For instance, using the vehicle for travel between home and work or incidental work-related activities typically qualifies for this exemption. However, extensive personal use, such as weekend trips, would disqualify the vehicle from this exemption.

Non-Commercial Vehicles: Non-commercial vehicles, like standard passenger cars, are subject to FBT. There are two primary methods to calculate FBT for these vehicles:

- Statutory Method: This method applies a flat rate of 20% of the vehicle’s value, making it straightforward but sometimes less cost-effective.

- Operating Cost Method: This method is based on actual operating costs and requires maintaining a logbook for 12 weeks to determine the business use percentage. This method can offer significant savings if the business use percentage is high.

Electric and Hybrid Vehicles Exemptions

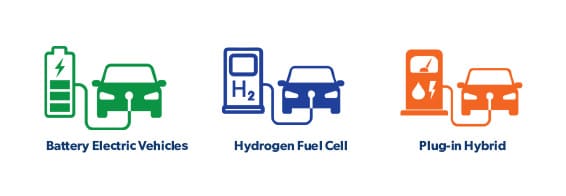

Recent legislative changes have introduced significant exemptions for electric vehicles (EVs), including battery electric vehicles, plug-in hybrid electric vehicles, and hydrogen fuel cell vehicles. These vehicles must meet specific criteria, such as being used from July 1, 2022, and valued below the luxury car tax threshold.

Benefits of Electric Vehicles:

- Cost Savings: Electric vehicles are generally cheaper to operate than traditional internal combustion engine vehicles due to lower fuel and maintenance costs.

- Environmental Impact: EVs contribute to reduced emissions, aligning with corporate sustainability goals.

Vehicles like the Tesla Model Y and Cupra Formentor, if used primarily for business, can benefit from these exemptions, reducing overall FBT liabilities.

Salary Packaging and Novated Leases

Salary packaging, including novated leases, offers a way for employees to lease vehicles using pre-tax income, leading to significant tax savings. Under a novated lease, the employer makes the lease payments, and the employee can use the vehicle for both business and personal purposes. This arrangement can cover various costs, such as fuel, maintenance, and insurance.

Advantages:

- Tax Savings: Employees can reduce their taxable income.

- Comprehensive Coverage: Costs like running expenses, registration, and insurance can be included.

Managing FBT with Logbooks and Declarations

Maintaining a detailed logbook is essential for businesses to accurately track the usage of vehicles and optimize FBT calculations. A valid logbook records the business and private use of the vehicle over a 12-week period. This data helps in determining the most cost-effective FBT calculation method.

Employee Contributions: Employees can make contributions towards the vehicle’s operating costs, which can further reduce the FBT liability. These contributions are deducted from the taxable value of the fringe benefit.

Additional Considerations and Exemptions

Several other exemptions can help businesses manage their FBT obligations more effectively:

- Minor Benefits Exemption: Benefits valued below $300 and provided infrequently can be exempt from FBT.

- Work-Related Exemptions: Benefits that would be deductible for the employee if purchased personally can be provided without incurring FBT. This includes tools of trade, protective clothing, and portable electronic devices used primarily for work.

- Electric Vehicle Exemption: Electric vehicles that meet specific criteria are exempt from FBT, promoting the use of low-emission and fuel-efficient vehicles.

Employers should also consider the FBT implications of providing additional benefits, such as charging equipment for electric vehicles, extended warranties, and service plans. Consulting with a tax professional can help businesses navigate these complexities and take full advantage of available exemptions and concessions.

Conclusion

Understanding the nuances of Fringe Benefits Tax for motor vehicles is essential for employers to manage their tax obligations effectively. By leveraging exemptions, maintaining detailed records, and considering salary packaging arrangements, businesses can minimize their FBT liabilities while providing valuable benefits to their employees. For tailored advice and to ensure compliance, consulting with a tax professional is highly recommended. This strategic approach not only helps in cost savings but also aligns with sustainable business practices by encouraging the use of electric and hybrid vehicles.

Want to find out more about FBT and the top exemptions for business owners? Download our free guide “FBT Guide 2024: Top 7 Exemptions For Your Business”.

FBT Ebook Form