In the world of business, cash is king. But many business owners struggle to manage their cash flow effectively, resulting in poor financial performance and even business failure. Discover why cash reserves are crucial for businesses and tips to improve cash flow & understanding your working capital.

Why Cash is King

Good cash reserves are essential for businesses to take advantage of opportunities and increase their overall value. Poor cash management is a leading cause of business failure, with 82% of business failures in Australia attributed to poor and irregular cash flow. Additionally, 44% of businesses are dependent on a credit facility to fund daily operations. The old adage rings true:

Revenue is vanity profit is sanity and cash is king.

Revenue is not enough to sustain a business, as it is cash in the bank that pays the bills. Therefore, businesses should prioritize cash flow management to ensure survival and success.

Where Did My Profits Go?

At the end of the year, many business owners are left wondering, “Where did my profits go?” despite seeing a positive net income on their profit and loss statement. The answer lies in understanding the importance of working capital and its impact on cash flow. Only when you understand this, can you improve cash flow.

To see this in play we highly recommend you check out our webinar on cashflow fundamentals:

Understanding Your Working Capital

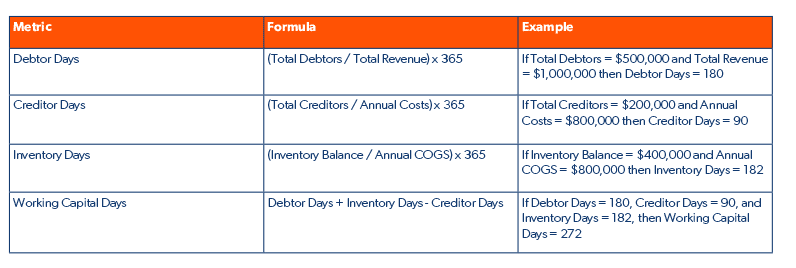

So, what is working capital? In simple terms, it's the difference between your current assets (such as cash, inventory, and accounts receivable) and your current liabilities (such as accounts payable and short-term loans). It shows the amount of money you have left over after paying off your short-term debts. To dive deeper into understanding your working capital, let's take a look at the cycle of cash flow in a business. In essence, you use your cash to purchase stock, pay suppliers, sell the stock, and get paid by debtors. The length and complexity of this cycle can have a significant impact on your business's success. To measure your working capital, there are several key metrics to consider:

Reducing your working capital cycle is the key to improve cash flow and profitability. Here are some tips to help you achieve this:

Improve Debtor Days: Have a robust accounts receivable policy, credit check new accounts, and follow up on outstanding payments. You can also consider using automation tools to make this process more efficient.

Reduce Inventory Days: Analyze your inventory turnover rate, avoid overstocking, and negotiate better terms with suppliers to reduce lead times.

Increase Creditor Days: Negotiate longer payment terms with suppliers, but be aware of any interest or penalties that may apply.

The 3F Approach

The 3F Framework can help with improving your cash flow and has three parts: Forecasting, Funding, and Focus.

Forecasting is crucial for good cash flow management. You need both a long-term and short-term cash flow forecast. Keep it updated weekly and focus on big numbers, not perfection.

Funding is also important. A good relationship with your bank manager is critical, and you should regularly review funding options and negotiate rates and fees.

Focus on improving cash flow by identifying quick fixes like overdue debts or slow-moving stock, but also spend regular time on structural improvements. Monitor your working capital and fixed costs, and review your funding mix.

We have an entire post dedicated to the 3F method that goes into it in far more detail, and also provides downloadable tools. Check it out here.

Surviving a Cash Flow Crisis

Cashflow crises can happen to any business, big or small. It can be stressful, and overwhelming and can lead to bad decision-making. However, there are steps you can take to overcome it. Here are some key steps to help you survive a cash flow crisis.

- Don't Panic

The first step when facing a cash flow crisis is to avoid panicking. Panicking can lead to making hasty decisions without considering the facts. It's important to take a deep breath, step back and assess the situation.

- Get the Facts

The next step is to get the facts. Speak to your accountant and get a clear understanding of your financial situation. Find out exactly who owes you money, when they'll pay, who you owe money to and when it's due. Make a list of all your short-term cash commitments, including overheads, salaries, and other expenses. Also, determine the amount of cash available to you from equity, funds outside the business or any credit facilities available through your bank.

- Communicate, Communicate, Communicate

Communication is key when dealing with a cash flow crisis. Communicate with your team, especially the management team, and make sure they understand the situation. Communicate with your customers and make sure they know when you expect payment. Also, communicate with your suppliers and try to establish a payment plan that works for both parties. Over-communication is better than under-communication in these situations.

- Tighten the Screws

When you're facing a cash flow crisis, it's important to tighten the screws on your finances. Focus on managing your accounts receivable and tighten the screws on inventory management. Identify what is moving and what isn't and manage your inventory accordingly. Additionally, go through your overheads line by line and identify any unnecessary expenses. Any money going out in the business should be to generate more money coming in.

- Make the Tough Decisions

If you're in a cash flow crisis, it may be necessary to make tough decisions. If you need to, establish a hit list of non-essential expenses that can be cut if needed. Take the emotion out of the situation and focus on the facts and data. If necessary, be prepared to turn off the tap to some areas that aren't delivering, whether that's departments or people.

7 Point Cash Flow Action Plan

This 7 point action plan takes into account all these factors, and is a surefire way to help you improve cash flow.

- Understanding your CCC (Cash Conversion Cycle) is essential for effective cash flow management.

- Creating a short-term cash flow forecast using templates provided can help you stay on top of your financial situation.

- Meet with your bank manager to discuss your commitments and explore options for financing.

- Investigating alternative funding sources beyond your bank can offer competitive options and greater flexibility.

- Reviewing your debtor management process can help you optimize payment collection and reduce accounts receivable days.

- Conducting inventory analysis can help you understand which products are profitable and which are not, allowing you to make informed decisions about stock levels and ordering.

- Negotiating payment terms with suppliers can help you manage cash flow by improving payment timing and reducing costs.