How to Think Like an Investor (and Build an Investment Ready Business)

Want to know how to grow your business? The secret to building a more profitable and valuable business, is to start thinking like someone who might want to invest in it.

In this article, we’ll cover:

- Why are You in Business?

- Its All About the Money

- Leveraging Your Balance Sheet

- Where’s the Cash?

- Risk vs. Reward

- What’s it Worth?

- Conclusion

Why Are You in Business?

As a business owner, its so easy to get stuck in the weeds of just ‘running the business’ day after day. Managing people. Making decisions. Doing what needs to be done. All the ‘stuff’ that needs to happen.

But sometimes, you just need to stop and ask the question…

What are we here for?

That is, why are you in business?

Sure, you’re gonna change the world. Dominate your industry. Provide the best products at half the price and twice the speed of anyone else. Enrich the lives of all your employees by empowering them to be the best version of themselves they can possibly be. Yawn.

But what are you in business for?

To make money.

Or, as Eliyahu Goldratt outlines in his book The Goal:

“To make money by increasing net profit, while simultaneously increasing return on investment, and increasing cash flow”

That should be every business owner’s goal. But that’s not normally the case. Because most business owners are too busy to actually hop off the hamster wheel and ask the tough questions.

Are we increasing profits? Increasing return? Increasing cashflow?

You know who asks these questions? An investor.

If you want to build an Investment Grade Business, you need to Think Like an Investor.

Not an engineer, or an inventor, or an entrepreneur, or an accountant. An investor.

Because your business is not just a job, or an occupation – it’s an investment.

Got that? Let’s dive in.

Its All About The Money

An investor thinks about profits.

You’re a business owner, you think about profits. I’m sure you do.

But do you think about profits the way an investor does?

Because profit is not just an outcome or a result – it’s the main objective, it’s the target you’re aiming for.

Too often business owners talk in terms of top line revenue – we’re aiming to grow to $20M next year, or we’ll double revenue in 3 years, or our BHAG is to be a $50M business. That’s not the goal, that’s just a means to an end.

You’ve heard it before – Revenue is vanity, profit is sanity.

What’s the bottom line? How much money will we make? At what margin? Is it increasing like it should? How does it stack up against the benchmark for our industry or businesses of this size? Do we have confidence in the forward projections and forecasts for the business?

These are the questions you should be asking.

Leveraging Your Balance Sheet

An investor thinks about return on investment.

So if you’re going to Think like an Investor, you need to understand your balance sheet. As a business owner, that’s where your investment is.

Let’s get something basic out of the way first.

All businesses are funded by a combination of Debt and Equity. Equity is your money (either capital put in or profits left in) and debt is other people’s money (usually the bank).

Now most business owners would understand the simple balance sheet formula, that Total Assets – Total Liabilities = Equity. Simple, right? What you own, vs what you owe.

Let’s look at a different one. Something that’s important to an investor.

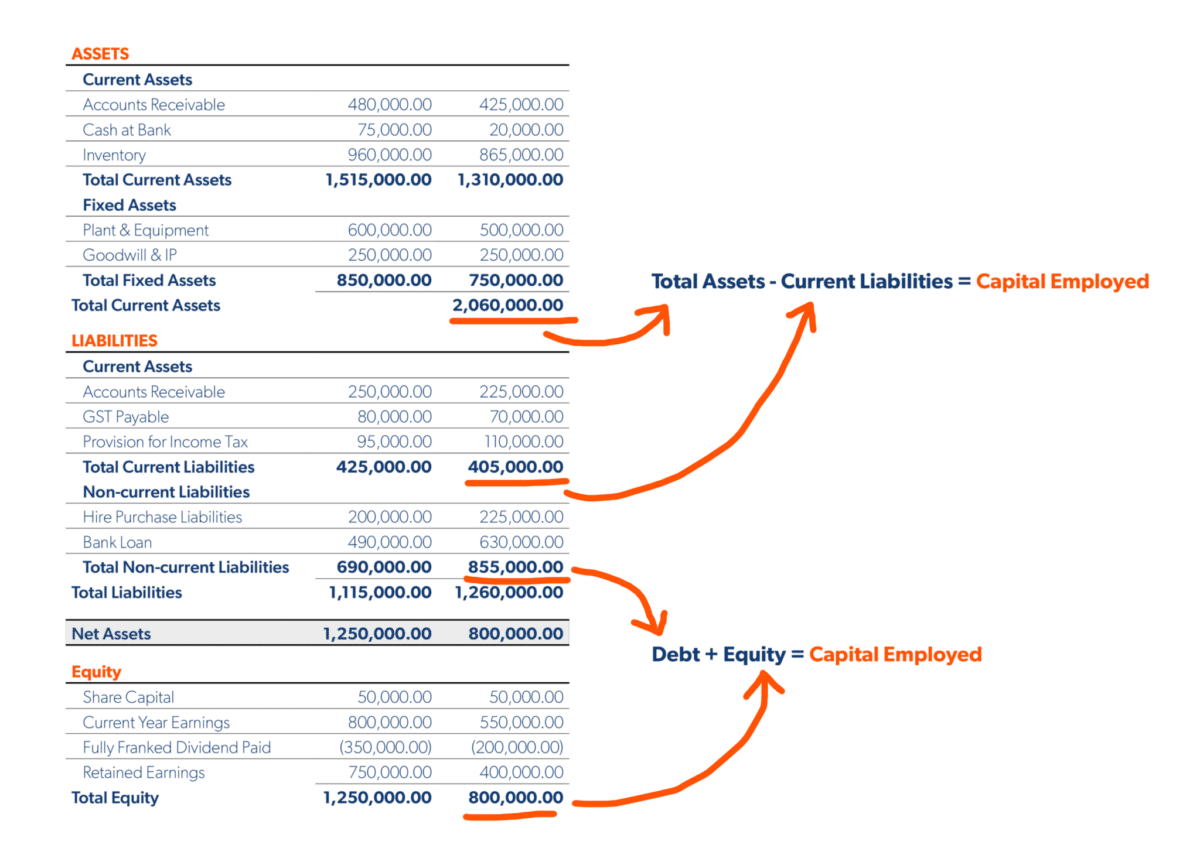

Equity + Debt = Capital Employed. Capital just means money in the business, whether it’s yours (equity) or someone else’s (debt). So Capital Employed simply means the money that is used (employed) to fund your net business assets. Or – how much money it takes to run your business.

To demonstrate this as a simple rule of thumb, it looks like this.

Total Assets – Current Liabilities = Debt + Equity = Capital Employed. (see below illustration)

As you can see, capital employed in real life funds the value of your debtors, stock, fixed assets, less any current liabilities such as creditors, tax provision etc.

Why is Capital Employed important? I’m so glad you asked!

Return on Capital Employed (ROCE)

If you’re going to Think like an Investor, you need to understand this ratio – Return on Capital Employed (ROCE).

ROCE measures how much money you make as a percentage of the funds that are invested in your business.

ROCE = Operating Profit / Capital Employed

So if you had $1M invested in your business and you made an operating profit of $250k, your ROCE is 25%.

What’s a good ROCE target? More on that later.

For now, if you can understand the connection between the balance sheet (funding of your business assets) and the P&L (return generated on those business assets), you’re already thinking like an investor.

“If you don’t find a way to make money while you sleep, you will work until you die.” ~ Warren Buffett ~

Where’s The Cash?

An investor thinks about cashflow.

Revenue is Vanity, Profit is Sanity, Cash is King….

So if an investment has cost you cash and is not generating cash – what’s the point? Maybe all your profits are being invested back into growth. Some investors are patient enough to wait years for a capital return, with little cashflow to speak of. But it’s a lot more fun when an investment actually generates positive cashflow!

Is your investment actually generating a cash return? Your business might be making profits, but are these profits turning into cash in the hands of the business owners?

A good business investment will typically provide regular dividends or distributions of profit. A business that can demonstrate a good history of paying regular dividends or distributions, will be worth more.

Many investors and business managers will actually set a target ratio for Free Cashflow – the measure of what percentage of operating profit turns to cash available for distribution to the business owners.

An investor also thinks about how much cash is tied up on the balance sheet. Every excess dollar of cash invested in working capital, or fixed assets – is a dollar out of cashflow.

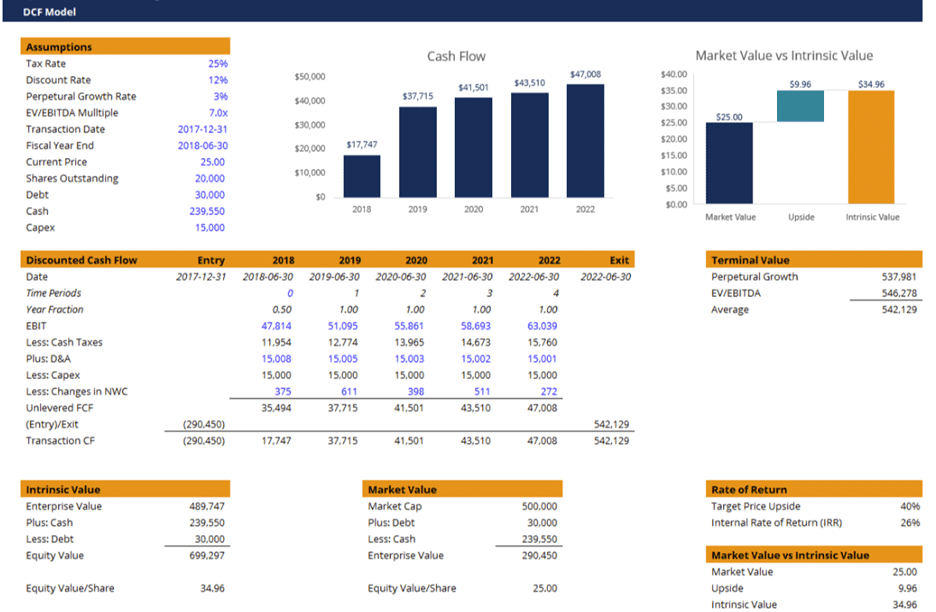

They will think about the value of cashflow over time that an investment will generate, this will actually drive their decision making process.

So when you’re setting your budgets and forecasts for your business, you really need to look past the P&L. What are the cash requirements to fund the balance sheet? How much free cashflow will the business generate to provide a return to the business owners?

Risk vs Reward

An investor thinks about risk.

Why? Because risk and reward are inextricably linked.

Think about this for a minute. You’ve got a million bucks spare. You put it in the bank. As at the time of writing this, the best interest rate you’re likely to get is around 5%.

Is 5% a good return? Well, it’s not a high return, but it is very low risk.

As a business owner, your investment is not low risk. You could go broke. You might get bad debts. An employee, customer, or supplier could sue you. A recession could impact your market. You could have a product recall, a fire, or a cyber attack. The list goes on.

So, if you can get 5% with next to no risk in the bank, what can you get in your business with all of that risk?

What should you get?

Risk Premium

This is where you need to understand the concept of a risk premium. A risk premium is how much extra return an investment should generate to account for the risk of the investment.

The 5% from the bank is pretty close to a ‘risk-free rate of return’. So, if a risk premium was 25%, the required rate of return would be 30%.

That is, if you can get 5% return from the bank with no risk, you need 30% return from your business to fairly account for the level of risk in it.

A risk premium might typically range from 10% for a low risk business, up to 50% for a very high risk business. 20% is a good rule of thumb for small and medium family businesses – add this to the interest rate of 5% and you have a benchmark of 25% ROCE.

Two other items that might influence what ROCE you’re after, will be your gearing and cost of capital. To avoid eyes glazing over, we won’t go into detail here – they’re topics for another day.

But gearing is essentially how much debt (other people’s money) you have in your business vs how much equity (your money). High gearing is more debt, low gearing is more equity.

Cost of capital means there is a cost of debt (average interest rate on your debt) but also a cost of equity (an arbitrary rate of opportunity cost). Weighted Average Cost of Capital (WACC) gives you the average of these two costs.

If your ROCE is higher than your WACC, you’re creating value in your business. If its lower, you’re destroying value.

Let’s move on.

What’s it Worth?

An investor thinks about value.

You should too.

As a business owner, your business is likely the most valuable asset you have. Do you know what it’s worth?

If you own your home, you likely know how much it cost you and what it’s worth in today’s market. If you own shares in a public company, you get an investor statement every quarter that tells you what your investment is valued at.

So, how about your business? Do you know the value?

For a business owner, regular profits and cashflow is only half the picture. You have the chance to create as much value (or more) in growing your Enterprise Value, as you do in banking those regular profits.

An investor thinks about future value, and how much they can grow the value of their investment. What is it worth now? What’s the target future value? What is the value gap? Is there a plan to close that gap?

You should ask those same questions of your business.

Let’s say your business is worth $5M. You have a target future value of $25M – that’s a $20M value gap. What are the 3-5 major initiatives or strategies that are going to close that gap? Identify those things and you have the bones of a value creation plan.

Whether you intend to sell your business soon, later, or never – is not really the point. Every business should be Built to Sell, because it will create a more profitable, enjoyable, and valuable business along the way.

Lastly, your business will be worth more if it isn’t dependent on you to run it.

So What Now?

Hopefully you can see that your business is more than an occupation, it is an investment.

As a business owner, it provides your greatest opportunity to build long term value and secure the future for you and your family. By adopting an investor mindset, you can focus on what really matters. Driving profitability and cash, generating strong returns, reducing risk and and building enterprise value.

Think like an investor. Watch your business thrive. Reap the rewards.

Glossary of Terms

B2S – Built To Sell

The core concept in the book by John Warrilow of the same name.

CE – Capital Employed

Capital employed, also known as funds employed, is the total amount of capital used for the acquisition of profits by a firm or project. Capital employed can also refer to the value of all the assets used by a company to generate earnings.

EBIT – Earnings Before Interest & Tax

Earnings before interest and taxes (EBIT) measures a company’s net income before income tax and interest expenses are deducted. EBIT is used to analyze the performance of a company’s core operations.

EBITDA – Earnings Before Interest, Tax, Depreciation and Amortisation

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of profitability to net income. By stripping out the non-cash depreciation and amortization expense as well as taxes and debt costs dependent on the capital structure, EBITDA attempts to represent cash profit generated by the company’s operations.

EV – Enterprise Value

Enterprise value (EV) measures a company’s total value, often used as a more comprehensive alternative to market capitalization.

FCF – Free Cash Flow

Free cash flow (FCF) is the money a company has left over after paying its operating expenses (OpEx) and capital expenditures (CapEx). The more free cash flow a company has, the more it can allocate to dividends, paying down debt, and growth opportunities.

OP – Operating Profit

A company’s operating profit is its total earnings from its core business functions for a given period, excluding the deduction of interest and taxes. (see EBIT)

RFR – Risk Free Rate of Return

The risk-free rate of return is the theoretical rate of return of an investment with zero risk. The risk-free rate represents the interest an investor would expect from an absolutely risk-free investment over a specified period of time.

ROCE – Return on Capital Employed

The term return on capital employed (ROCE) refers to a financial ratio that can be used to assess a company’s profitability and capital efficiency.

RP – Risk Premium

A risk premium is the investment return an asset is expected to yield in excess of the risk-free rate of return. An asset’s risk premium is a form of compensation for investors. It represents payment to investors for tolerating the extra risk in a given investment over that of a risk-free asset.

WACC – Weighted Average Cost of Capital

Weighted average cost of capital (WACC) represents a firm’s average after-tax cost of capital from all sources, including common stock, preferred stock, bonds, and other forms of debt. WACC is the average rate that a company expects to pay to finance its assets.

Partnering with Quantum Advisory allows you to focus on what you do best – running your business – while leaving the financial aspects in capable hands. Contact us today to supercharge your company, become more profitable and plan for the future.